How to Invest in Gold: A Comprehensive Guide

Gold has been a symbol of wealth and security for centuries, and today it remains one of the most popular investment options. Whether you’re new to investing or looking to diversify your portfolio, understanding how to invest in gold can help you make informed financial decisions. This guide covers everything you need to know about gold investments, including the benefits, risks, and various methods available.

The Importance of Investing in Gold

Investing in gold is often considered a safe haven during economic uncertainties. Gold retains its value over time, providing a hedge against inflation and currency fluctuations. For centuries, it has been used as a store of value and a medium of exchange. By understanding how to invest in gold, you can add stability to your portfolio and protect your wealth.

Gold’s importance as an investment lies in its ability to diversify a portfolio. Unlike stocks and bonds, gold often moves independently of traditional financial markets. This inverse relationship makes it an attractive option for risk-averse investors. Before diving into how to invest in gold, it’s crucial to understand its unique role in wealth management.

Different Ways to Invest in Gold

When considering how to invest in gold, you’ll find several options to suit your financial goals and risk tolerance. These methods include purchasing physical gold, investing in gold ETFs, buying shares of gold mining companies, or exploring gold futures and options. Let’s delve into these options to help you choose the right approach.

Physical Gold

Physical gold, such as coins, bars, and jewelry, is one of the most direct ways to invest in gold. Owning physical gold provides a tangible asset that can be stored for future use or sold during economic crises. When learning how to invest in gold, consider storage and insurance costs for physical assets.

Physical gold is ideal for those who prefer a hands-on investment. However, it’s essential to ensure authenticity and purchase from reputable dealers. This method may involve higher premiums and fees compared to other forms of gold investment.

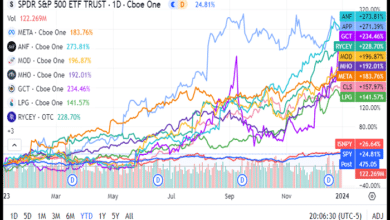

Gold ETFs and Mutual Funds

Gold Exchange-Traded Funds (ETFs) and mutual funds provide an accessible way to invest in gold without dealing with physical storage. ETFs track the price of gold, while mutual funds may include gold-related assets. When exploring how to invest in gold, these options offer liquidity and diversification.

ETFs and mutual funds are popular among investors seeking exposure to gold’s price movements without the complexities of physical ownership. They are traded on stock exchanges, making it easy to buy and sell shares. Additionally, these investments often have lower fees than purchasing physical gold.

Gold Mining Stocks

Another way to invest in gold is through shares of gold mining companies. These stocks allow you to benefit from the profitability of gold mining operations. When researching how to invest in gold, keep in mind that mining stocks can be volatile and influenced by factors beyond gold prices, such as operational efficiency and geopolitical events.

Investing in gold mining stocks requires careful analysis of individual companies. Look for well-established miners with strong financial performance and low production costs. This method offers leverage to gold prices but comes with additional risks.

Gold Futures and Options

For experienced investors, gold futures and options provide leveraged exposure to gold prices. Futures contracts involve agreeing to buy or sell gold at a predetermined price on a specific date. Options give you the right, but not the obligation, to do so. Learning how to invest in gold through these instruments requires a solid understanding of derivatives and market dynamics.

Gold futures and options are high-risk, high-reward investments. They are suitable for traders with significant experience and a strong risk tolerance. These instruments allow for speculative strategies and hedging against price fluctuations.

Digital Gold

Digital gold is a modern and convenient way to invest in gold. Platforms allow investors to buy and sell fractional ownership of physical gold stored in secure vaults. When considering how to invest in gold, digital options provide accessibility and transparency.

Digital gold investments are ideal for tech-savvy investors seeking low entry barriers. These platforms often have minimal fees and offer real-time price tracking. Ensure you use a trustworthy platform to guarantee the security of your investment.

Benefits of Investing in Gold

Understanding how to invest in gold includes recognizing its benefits. Gold offers several advantages, such as diversification, liquidity, and protection against economic instability. These qualities make gold an essential component of any well-rounded investment portfolio.

Gold’s historical resilience during financial crises has earned it the reputation of a safe haven asset. It maintains value over time and acts as a hedge against inflation. Moreover, gold is a globally recognized asset, ensuring liquidity in nearly any market.

Risks and Challenges of Gold Investments

While gold is a valuable investment, it’s not without risks. Learning how to invest in gold involves understanding potential challenges, such as price volatility, storage costs, and limited income generation. By being aware of these risks, you can make more informed investment decisions.

Gold prices can be influenced by global economic trends, central bank policies, and market sentiment. Additionally, physical gold investments require secure storage and insurance. Unlike stocks or bonds, gold does not generate dividends or interest, which may limit its appeal for income-focused investors.

How to Start Investing in Gold

If you’re ready to learn how to invest in gold, follow these steps:

- Set Your Investment Goals: Determine your financial objectives and risk tolerance.

- Choose Your Investment Method: Decide whether to invest in physical gold, ETFs, mining stocks, or other options.

- Research the Market: Stay informed about gold price trends and market dynamics.

- Select a Reputable Dealer or Platform: Ensure authenticity and security when purchasing gold.

- Diversify Your Portfolio: Include gold as part of a balanced investment strategy.

Starting small and gradually increasing your exposure to gold can help mitigate risks. Always conduct thorough research and consider seeking professional advice.

Tips for Successful Gold Investment

To maximize returns, keep these tips in mind while learning how to invest in gold:

- Monitor gold price trends and market conditions.

- Avoid emotional decisions based on short-term fluctuations.

- Invest only what you can afford to lose.

- Consider long-term holding periods for physical gold.

- Regularly review your investment strategy.

By following these tips, you can enhance your understanding of how to invest in gold and build a robust portfolio.

Conclusion

Investing in gold is a timeless strategy for preserving wealth and achieving financial stability. By understanding how to invest in gold and exploring various options, you can make informed decisions that align with your goals. Whether through physical gold, ETFs, or other methods, incorporating gold into your portfolio can provide diversification and protection against economic uncertainties.

FAQs

1. Is gold a good investment in 2024? Yes, gold remains a solid investment option in 2024, offering stability and a hedge against inflation.

2. What is the best way to invest in gold? The best way depends on your goals. Physical gold is ideal for long-term security, while ETFs and stocks offer liquidity.

3. How much gold should I have in my portfolio? Financial experts recommend allocating 5-10% of your portfolio to gold for diversification.

4. Can I invest in gold with a small budget? Yes, options like digital gold and fractional ownership make it accessible to investors with smaller budgets.

5. What are the tax implications of gold investments? Tax rules vary by country. In most cases, gold investments are subject to capital gains tax when sold at a profit.