How to Invest in Bonds: One-Stop Gateway for Beginners

Bond investing can be a powerful addition to your financial portfolio. It provides stability, predictable income, and an effective way to diversify. For those new to the world of bond investments, understanding the basics and the various strategies involved can seem daunting. This one-stop gateway guide on how to invest in bonds will walk you through everything you need to know. From the types of bonds to how to buy them, we’ve got you covered.

What Are Bonds? An Overview of Bond Investing

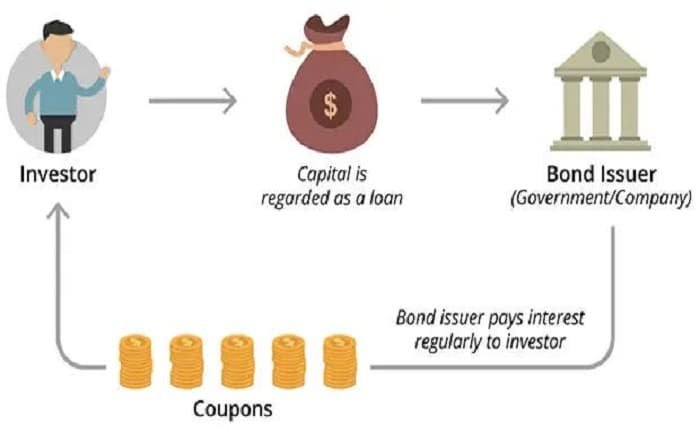

When learning how to invest in bonds, understanding the basics is crucial. Bonds are essentially loans you make to companies or governments in exchange for periodic interest payments and the return of your original investment after a specific term. Bonds are often seen as safer investments compared to stocks, providing steady income and helping to diversify portfolios. Understanding how bonds work is the first step in utilizing them as part of a balanced investment strategy.

Benefits of Investing in Bonds

Understanding the benefits of how to invest in bonds can help you make informed decisions. Bonds offer several advantages, such as predictable income in the form of interest payments, reduced investment risk, and diversification. Bonds are less volatile than stocks and provide stability, which makes them a safe haven in times of economic uncertainty. Additionally, bonds help preserve capital while still earning a modest return, making them an excellent option for conservative investors.

Different Types of Bonds You Can Invest In

When exploring how to invest in bonds, it’s essential to recognize the various types available. Bonds come in different forms, including government bonds, corporate bonds, municipal bonds, and savings bonds. Government bonds, like U.S. Treasury bonds, are often considered the safest, while corporate bonds are issued by companies looking to raise funds. Municipal bonds are issued by state or local governments, providing tax benefits to investors. Knowing which type of bond fits your financial goals will make your investing experience much smoother.

How to Invest in Bonds: Step-by-Step Guide

To understand how to invest in bonds, you need to follow a simple step-by-step process. Start by determining your investment goals and risk tolerance. Once you have clarity, choose the type of bond that aligns with your goals. You can buy bonds through a broker, a bank, or directly from the government. Consider working with a financial advisor if you’re unsure of how to navigate the bond market. Research the bond ratings, interest rates, and maturity dates before making a purchase.

Risks Involved in Bond Investing

It’s important to be aware of the risks when learning how to invest in bonds. Bonds, while generally safer than stocks, are not risk-free. Interest rate risk is one of the main concerns; when interest rates rise, bond prices tend to fall. There’s also the risk of default, especially with corporate bonds, meaning the issuer might fail to pay interest or return the principal. Inflation can erode your returns as well. Understanding these risks will help you make more strategic investment decisions.

Key Terms You Need to Know When Investing in Bonds

If you want to learn how to invest in bonds effectively, it’s essential to understand certain key terms. These include yield, which refers to the return on investment from a bond, and maturity, which is when the bond issuer repays your principal. Another important term is coupon rate, which is the interest rate paid by the bond issuer. Understanding these terms will help you evaluate potential bond investments and choose the right bonds to meet your financial goals.

Strategies for Investing in Bonds

Learning how to invest in bonds also involves understanding different strategies. One strategy is laddering, which involves buying bonds with different maturity dates to reduce risk. Another popular strategy is investing in bond funds, which allows you to diversify by pooling money into various bonds. Some investors prefer buying and holding bonds until maturity, while others engage in active trading to take advantage of price fluctuations. Knowing which strategy fits your needs will help you maximize your bond investment returns.

How to Buy Bonds: Platforms and Options

To fully grasp how to invest in bonds, you need to know where to buy them. Bonds can be purchased through various channels, including brokers, banks, and government platforms like TreasuryDirect. Brokerages offer the widest selection of bonds but may charge a fee. Government bonds can often be bought directly online with minimal fees. Exchange-traded funds (ETFs) and mutual funds that focus on bonds are also excellent ways to get started if you prefer diversified exposure without purchasing individual bonds.

Tax Considerations When Investing in Bonds

Tax implications play an important role in understanding how to invest in bonds. Interest income from bonds is generally taxable, but municipal bonds often provide tax-free income at the federal level, and sometimes at the state level. Treasury bonds are exempt from state and local taxes but are subject to federal taxes. It’s essential to consider how taxes impact your overall return, and consulting a tax professional can help you navigate these waters and make better investment choices.

Common Mistakes to Avoid When Investing in Bonds

To master how to invest in bonds, it’s helpful to understand common pitfalls. One mistake is ignoring interest rate risk; rising rates can decrease your bond’s value. Another mistake is concentrating too much on one type of bond, which reduces diversification and increases risk. Failing to understand the bond ratings is another common error. It’s essential to diversify your bond investments and be aware of market conditions to avoid potential losses and maximize your investment returns.

Conclusion

Learning how to invest in bonds can be an excellent step towards achieving a diversified and stable financial portfolio. Bonds offer a range of benefits, including predictable income, capital preservation, and reduced risk, making them suitable for conservative investors and those looking for stability. By understanding the types of bonds, the risks involved, and the strategies you can employ, you’ll be better equipped to make informed decisions. Use this one-stop gateway guide to explore the world of bonds and achieve your financial goals with greater confidence.

FAQs

1. What is the minimum amount needed to invest in bonds?

The minimum amount varies based on the type of bond and the issuing entity. Some government bonds can be purchased for as little as $100, while corporate bonds may require larger investments.

2. Can I lose money investing in bonds?

Yes, you can lose money if interest rates rise, bond prices fall, or the issuer defaults. However, investing in high-quality bonds and holding them to maturity reduces these risks.

3. What’s the difference between bond funds and individual bonds?

Individual bonds pay interest and return the principal at maturity, while bond funds pool multiple bonds, offering diversified exposure but without a guaranteed return of principal.

4. How do interest rates affect bonds?

When interest rates rise, bond prices typically fall, reducing the value of your bond investment. Conversely, when interest rates fall, bond prices rise.

5. Is it better to buy bonds through a broker or directly?

It depends on your needs. Brokers offer a wide selection, but direct purchases (e.g., from the government) may have lower fees. Consider your investment strategy and costs before deciding.