How to Invest in the S&P 500: A Comprehensive Guide for Beginners

Introduction

Investing in the S&P 500 is one of the most popular strategies for both novice and seasoned investors alike. The S&P 500, or the Standard & Poor’s 500, is a stock market index that tracks the performance of 500 of the largest publicly traded companies in the United States. This index is widely regarded as a reliable indicator of the overall health of the U.S. economy and is a favorite among those looking to diversify their investment portfolios. In this blog post, we will explore the intricacies of how to invest in the S&P 500, covering everything from the basics to more advanced strategies.

What is the S&P 500?

Before diving into how to invest in the S&P 500, it’s essential to understand what the S&P 500 is. The S&P 500 is a market-capitalization-weighted index, meaning that the companies with the largest market caps have the most significant impact on the index’s performance. Companies like Apple, Microsoft, Amazon, and Google are some of the heavyweights in this index. When you learn how to invest in the S&P 500, you’re essentially buying a small piece of these large companies, which can provide both stability and growth potential to your investment portfolio.

Why Invest in the S&P 500?

Understanding why you should invest in the S&P 500 is crucial before taking any steps. The S&P 500 has historically provided strong returns, averaging about 10% per year over the long term. This makes it an attractive option for those looking to build wealth over time. When you learn how to invest in the S&P 500, you’re investing in a diversified portfolio that spans various industries, reducing the risk associated with individual stocks. Additionally, investing in the S&P 500 is often recommended for retirement accounts due to its stability and growth potential.

How to Invest in the S&P 500 Through Index Funds

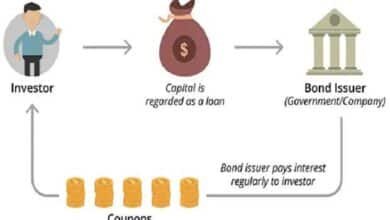

One of the most straightforward ways to learn how to invest in the S&P 500 is through index funds. Index funds are mutual funds or exchange-traded funds (ETFs) designed to replicate the performance of a specific index, in this case, the S&P 500. By investing in an S&P 500 index fund, you’re buying shares that represent all 500 companies in the index. This method is ideal for beginners because it requires minimal effort to manage and usually comes with lower fees compared to actively managed funds.

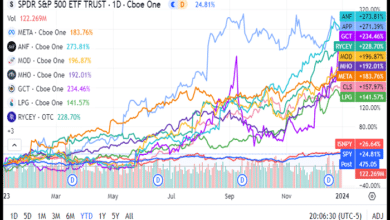

How to Invest in the S&P 500 Through ETFs

Exchange-Traded Funds (ETFs) are another popular method for those looking to learn how to invest in the S&P 500. ETFs are similar to index funds but are traded on stock exchanges like individual stocks. This means you can buy and sell ETFs throughout the trading day at market prices. Learning how to invest in the S&P 500 through ETFs offers flexibility and convenience, as well as the ability to start with a relatively small amount of capital. ETFs like SPDR S&P 500 ETF Trust (SPY) and Vanguard S&P 500 ETF (VOO) are among the most popular choices.

How to Invest in the S&P 500 Through Mutual Funds

Another approach to learning how to invest in the S&P 500 is through mutual funds. Mutual funds pool money from multiple investors to buy a diversified portfolio of stocks, bonds, or other securities. When you invest in an S&P 500 mutual fund, you’re purchasing shares that give you exposure to all the companies in the index. While mutual funds generally have higher fees than ETFs, they offer professional management and the possibility of dividend reinvestment, making them a viable option for long-term investors.

How to Invest in the S&P 500 Through Retirement Accounts

Investing in the S&P 500 through retirement accounts like a 401(k) or an IRA is a smart way to build wealth over time. Most retirement plans offer S&P 500 index funds or ETFs as investment options. Learning how to invest in the S&P 500 through these accounts can provide tax advantages, such as tax-deferred growth or tax-free withdrawals, depending on the type of account. This makes retirement accounts an excellent vehicle for those planning for the long term and wanting to benefit from the compound growth of the S&P 500.

How to Choose the Right S&P 500 Fund

Choosing the right S&P 500 fund is a critical step in learning how to invest in the S&P 500. There are many options available, each with its own expense ratio, performance history, and management style. When selecting a fund, consider factors such as fees, historical returns, and the reputation of the fund manager. Comparing these elements will help you choose a fund that aligns with your investment goals and risk tolerance. Websites like Morningstar provide tools and ratings that can assist you in making an informed decision.

How to Manage Your S&P 500 Investment

Once you’ve learned how to invest in the S&P 500, managing your investment is key to long-term success. Regularly reviewing your portfolio, rebalancing your investments, and staying informed about market trends are essential practices. If you’re investing through a retirement account, consider setting up automatic contributions to take advantage of dollar-cost averaging. By staying proactive and informed, you can maximize the potential of your S&P 500 investment and adjust your strategy as needed.

The Risks of Investing in the S&P 500

While learning how to invest in the S&P 500 offers many benefits, it’s also important to understand the risks involved. The S&P 500 is subject to market volatility, and your investment’s value can fluctuate significantly in the short term. Economic downturns, interest rate changes, and global events can all impact the performance of the index. However, by maintaining a long-term perspective and diversifying your portfolio, you can mitigate some of these risks and increase the likelihood of achieving your financial goals.

Conclusion

Investing in the S&P 500 can be a powerful way to build wealth over time, but it’s not without its challenges. By learning how to invest in the S&P 500, you equip yourself with the knowledge needed to make informed decisions and navigate the complexities of the stock market. Whether you choose to invest through index funds, ETFs, or mutual funds, understanding the fundamentals and risks is crucial. Ultimately, the decision to invest in the S&P 500 should align with your financial goals, risk tolerance, and investment horizon.

FAQs

1. What is the minimum amount required to invest in the S&P 500?

The minimum amount required to invest in the S&P 500 varies depending on the platform or fund you choose. Some ETFs allow you to start with as little as the cost of one share, which could be under $100.

2. Can I invest in the S&P 500 through my 401(k)?

Yes, many 401(k) plans offer S&P 500 index funds as an investment option. Investing in the S&P 500 through your 401(k) can be a tax-efficient way to build retirement savings.

3. How often should I review my S&P 500 investment?

It’s generally recommended to review your S&P 500 investment at least once a year. Regular reviews help ensure that your investment strategy aligns with your financial goals and risk tolerance.

4. Are there any tax implications when investing in the S&P 500?

Yes, there are tax implications when investing in the S&P 500, especially if you’re investing through a taxable account. Understanding capital gains taxes and the benefits of tax-advantaged accounts like IRAs can help you manage your tax liability.

5. What is the difference between investing in an S&P 500 ETF and an S&P 500 mutual fund?

The primary difference between an S&P 500 ETF and a mutual fund is how they are traded. ETFs are traded on stock exchanges throughout the day, while mutual funds are bought and sold at the end of the trading day. ETFs often have lower fees, but mutual funds offer the possibility of dividend reinvestment and professional management.