How to Invest Money to Make Money: A Comprehensive Guide for Beginners

Many people wonder, “How to invest money to make money?” The concept of investing to grow wealth can be both exciting and overwhelming for beginners. However, understanding the principles of investment, along with the right strategies, can help you navigate the world of finance confidently. In this blog post, we will explore various ways to invest money to make money, from traditional methods to modern alternatives. Whether you’re looking for short-term gains or long-term growth, there are numerous avenues to explore.

The Basics of How to Invest Money to Make Money

Before you begin investing, it’s essential to understand the basics of how to invest money to make money. Investing involves putting your money into assets, such as stocks, bonds, mutual funds, real estate, or businesses, with the expectation that their value will increase over time. Unlike savings, where your money sits idle, investments have the potential to generate returns through appreciation, dividends, or interest. However, investing also comes with risks, and it is important to balance risk and reward based on your financial goals and time horizon.

Start by Setting Clear Financial Goals on How to Invest Money to Make Money

The first step in learning how to invest money to make money is setting clear financial goals. Ask yourself why you are investing—whether it is to save for retirement, buy a house, or build a college fund for your children. Understanding your goals will help you determine the best investment strategy and risk tolerance. For example, if you are investing for retirement in 30 years, you might be more willing to take on higher-risk investments, such as stocks. On the other hand, if your goal is to save for a down payment on a home in five years, you may prefer low-risk options like bonds or a high-yield savings account.

How to Invest Money to Make Money with Stocks

One of the most popular ways to invest money to make money is through the stock market. When you invest in stocks, you are buying a share of a company’s ownership. Stocks have the potential to grow in value over time as the company increases its profitability. Additionally, many companies pay dividends to shareholders, providing a steady stream of income. However, investing in stocks can be volatile, and the market can fluctuate dramatically in the short term. It’s important to research and diversify your stock portfolio to minimize risk and increase the likelihood of making money.

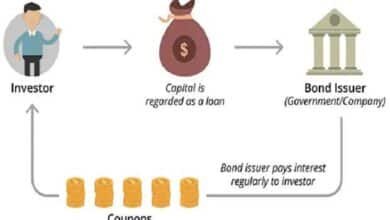

How to Invest Money to Make Money with Bonds

Another traditional method of investing money to make money is through bonds. Bonds are debt securities issued by governments or corporations, where you lend your money to the issuer in exchange for regular interest payments. Bonds are generally considered safer than stocks, as they provide a fixed income. However, the returns on bonds are usually lower compared to stocks, and there is still a risk of default if the issuer cannot make payments. Government bonds are typically considered the safest, while corporate bonds come with varying levels of risk depending on the company’s financial stability.

How to Invest Money to Make Money with Real Estate

Real estate investment is another proven way to make money over time. By purchasing property, either residential or commercial, you can earn rental income while also benefiting from potential property value appreciation. Real estate can be a lucrative investment, especially in growing markets, but it also requires significant capital upfront and ongoing maintenance costs. Additionally, the market can fluctuate, and property values may not always rise. To invest money in real estate wisely, consider location, market trends, and your long-term goals. Real estate investment trusts (REITs) are another option for those who prefer a more hands-off approach.

How to Invest Money to Make Money with Mutual Funds

Mutual funds are an excellent way for beginners to learn how to invest money to make money. A mutual fund pools money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. This diversification reduces risk while providing exposure to a wide range of investment opportunities. Mutual funds are managed by professional fund managers, making them an attractive option for individuals who prefer a passive investment approach. They come in different categories, such as equity funds, bond funds, or balanced funds, each offering different risk levels and returns.

How to Invest Money to Make Money with Index Funds

Index funds are a type of mutual fund that aims to replicate the performance of a specific market index, such as the S&P 500. Investing in index funds is a popular strategy for making money in the stock market, as they offer low fees, diversification, and consistent returns over time. Index funds are an excellent option for those who want to invest money to make money without actively managing their portfolio. Since index funds track the overall market or a sector, they tend to be less volatile than individual stocks and are a great choice for long-term investors.

How to Invest Money to Make Money with Peer-to-Peer Lending

Peer-to-peer (P2P) lending has become an increasingly popular alternative investment method. P2P lending platforms allow you to lend money directly to individuals or small businesses in exchange for interest payments. This form of investing can yield high returns, but it also carries more risk compared to traditional investments like bonds. The risk is higher because the borrower might default on the loan, and the investment is less liquid. However, P2P lending allows investors to diversify their portfolio and invest smaller amounts in multiple loans to spread the risk.

How to Invest Money to Make Money with Cryptocurrency

Cryptocurrency has emerged as a high-risk, high-reward investment option. Cryptocurrencies like Bitcoin, Ethereum, and others have shown tremendous growth in recent years. Investing in cryptocurrency offers the potential for significant profits, but it’s crucial to understand the volatile nature of this market. The value of cryptocurrencies can fluctuate rapidly, and the market is largely unregulated, which increases the risk. If you’re considering investing money in cryptocurrency, ensure you do thorough research and only invest what you can afford to lose.

How to Invest Money to Make Money with High-Yield Savings Accounts

For those who prefer low-risk options, a high-yield savings account can be a great way to invest money to make money. While savings accounts do not offer the same potential for returns as stocks or real estate, they provide a secure and accessible way to grow your money over time. High-yield savings accounts offer a higher interest rate than traditional savings accounts, allowing your money to grow faster. While the returns are modest, they are virtually risk-free, making them ideal for emergency funds or short-term savings goals.

Conclusion: How to Invest Money to Make Money Wisely

Knowing how to invest money to make money is an essential skill in today’s financial landscape. Whether you choose to invest in stocks, bonds, real estate, or alternative assets, the key to success is understanding your goals, risk tolerance, and time horizon. Diversifying your investments across different asset classes can help you mitigate risk and increase the likelihood of making money over time. Always do thorough research, stay informed, and consider seeking advice from financial professionals to ensure you’re making the best investment choices for your financial future.

FAQs

- What is the best way to invest money to make money for beginners?

The best way for beginners to invest money is to start with low-cost, diversified options like index funds, mutual funds, or high-yield savings accounts. - How much money do I need to start investing?

You can start investing with as little as $50 to $100, depending on the investment vehicle. Many platforms offer fractional shares, allowing you to invest small amounts. - What is the risk of investing money to make money?

All investments carry some level of risk, from market fluctuations to potential losses. Diversifying your investments can help reduce risk. - Is real estate a good way to invest money to make money?

Real estate can be a profitable investment, but it requires significant capital and management. It’s ideal for long-term investors seeking passive income and appreciation. - Can I make money from cryptocurrency investments?

While cryptocurrency investments can yield high returns, they are highly volatile and speculative. It’s important to do thorough research and be prepared for potential losses.