How to Invest My Money: A Comprehensive Guide to Building Wealth

Introduction

When considering how to invest my money, the first step is understanding the basics of investing. Investing involves putting your money into various financial instruments, such as stocks, bonds, real estate, or mutual funds, with the expectation of earning a return over time. Knowing how to invest my money effectively requires a clear understanding of risk tolerance, financial goals, and the different types of investment options available. In this guide, we’ll explore various strategies and tips to help you make informed decisions on how to invest my money for long-term financial growth.

Assessing Your Financial Situation

Before deciding how to invest my money, it’s essential to assess your current financial situation. This involves taking a close look at your income, expenses, debt, and savings. Understanding your financial standing will help you determine how much money you can comfortably invest. When considering how to invest my money, it’s also important to establish an emergency fund, ensuring that you have a financial cushion in case of unexpected expenses. By evaluating your finances, you’ll be better equipped to decide how to invest my money wisely and align your investments with your financial goals.

Setting Clear Investment Goals

One of the most critical steps in determining how to invest my money is setting clear investment goals. These goals could include saving for retirement, purchasing a home, funding education, or building wealth for future generations. When you know what you’re working towards, it’s easier to choose the right investment strategy. For example, if you’re focused on retirement, you might prioritize long-term growth investments. If you’re saving for a short-term goal, more conservative options might be better. By defining your goals, you’ll have a clearer path on how to invest my money to achieve them.

Diversifying Your Investment Portfolio

Diversification is a key principle when learning how to invest my money. It involves spreading your investments across various asset classes, such as stocks, bonds, real estate, and cash equivalents, to reduce risk. The idea behind diversification is that by investing in different types of assets, you can protect yourself from significant losses if one investment performs poorly. When considering how to invest my money, diversifying your portfolio ensures that you’re not putting all your eggs in one basket, thus minimizing potential risks while maximizing opportunities for growth.

Choosing Between Active and Passive Investing

When figuring out how to invest my money, you’ll need to decide between active and passive investing. Active investing involves frequently buying and selling investments to outperform the market, while passive investing involves holding investments for the long term, often through index funds or exchange-traded funds (ETFs). Each approach has its advantages and disadvantages, and the right choice depends on your investment goals, risk tolerance, and the time you can dedicate to managing your investments. Understanding these options will help you determine the best strategy for how to invest my money.

Exploring Different Types of Investments

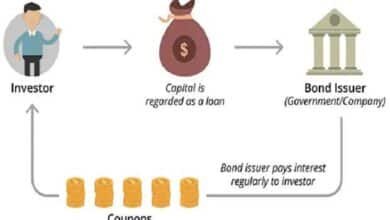

To effectively decide how to invest my money, it’s important to explore the different types of investments available. Stocks, bonds, mutual funds, real estate, and cryptocurrencies are just a few options to consider. Each type of investment comes with its own set of risks and rewards. For example, stocks offer the potential for high returns but are more volatile, while bonds provide steady income with lower risk. Real estate can be a good option for long-term growth, and cryptocurrencies offer high-risk, high-reward potential. By understanding these options, you’ll be better prepared to make informed decisions on how to invest my money.

Risk and Reward

When learning how to invest my money, it’s crucial to understand the relationship between risk and reward. Generally, the higher the potential return of an investment, the greater the risk involved. It’s important to assess your risk tolerance before deciding how to invest my money. If you’re more risk-averse, you might prefer investments with lower returns but more stability, such as bonds or dividend-paying stocks. If you’re willing to take on more risk for the chance of higher returns, growth stocks or real estate might be better options. Balancing risk and reward is key to successfully investing your money.

The Importance of Time Horizon in Investing

Your time horizon plays a significant role in determining how to invest my money. A time horizon is the length of time you expect to hold an investment before you need to access the funds. For example, if you’re investing for retirement 30 years from now, you can afford to take on more risk because you have time to ride out market fluctuations. Conversely, if you’re saving for a down payment on a house in five years, you’ll want to choose safer investments. Understanding your time horizon helps you make smarter decisions about how to invest my money.

The Role of Financial Advisors in Investing

If you’re unsure about how to invest my money, seeking the help of a financial advisor can be beneficial. Financial advisors offer professional guidance on investment strategies, portfolio management, and financial planning. They can help you assess your financial situation, set realistic goals, and develop a personalized investment plan. While there’s a cost associated with hiring a financial advisor, the expertise they provide can be invaluable, especially for those new to investing. A financial advisor can simplify the process of figuring out how to invest my money and help you stay on track to reach your financial goals.

Monitoring and Adjusting Your Investments

Investing is not a one-time activity; it requires ongoing monitoring and adjustments. As you learn how to invest my money, you’ll need to regularly review your portfolio to ensure it aligns with your goals and risk tolerance. Market conditions, life events, and financial goals can change over time, necessitating adjustments to your investment strategy. By staying engaged with your investments and making necessary changes, you can better manage risk and maximize returns. Regularly assessing your investments is a critical component of learning how to invest my money effectively.

Conclusion

Understanding how to invest my money is a powerful step toward securing your financial future. By assessing your financial situation, setting clear goals, diversifying your portfolio, and staying informed, you can make informed decisions that align with your objectives. Whether you’re a novice or an experienced investor, the principles outlined in this guide will help you navigate the complexities of investing and build wealth over time. Remember, the key to successful investing is not just knowing how to invest my money, but also committing to continuous learning and adapting to changes in the financial landscape.

FAQs

1. What is the first step in deciding how to invest my money?

The first step in deciding how to invest my money is assessing your current financial situation, including income, expenses, and savings, to determine how much you can invest.

2. Why is diversification important when learning how to invest my money?

Diversification is crucial when learning how to invest my money because it helps reduce risk by spreading investments across different asset classes.

3. Should I choose active or passive investing when figuring out how to invest my money?

Choosing between active and passive investing depends on your goals, risk tolerance, and time commitment. Both have their benefits, so it’s important to decide which aligns best with your investment strategy when considering how to invest my money.

4. How do I determine my risk tolerance when deciding how to invest my money?

Your risk tolerance can be determined by assessing how comfortable you are with potential losses in exchange for the possibility of higher returns, which is crucial when deciding how to invest my money.

5. Is it necessary to hire a financial advisor to learn how to invest my money?

While not necessary, hiring a financial advisor can provide valuable guidance and expertise, especially if you’re new to investing and want personalized advice on how to invest my money.