Investing money is an essential step in building wealth and achieving financial freedom. Whether you’re a novice or an experienced investor, finding the best way to invest money can significantly impact your financial growth. This guide covers strategies, investment options, and tips to help you make informed decisions. Let’s explore the diverse opportunities available today.

Why Investing Money is Crucial for Your Future

The best way to invest money starts with understanding its importance. Investing ensures your money grows over time, combating inflation and creating long-term wealth. Instead of letting cash sit idle, investment channels like stocks, real estate, and mutual funds offer better returns. Prioritizing investments over savings alone is the cornerstone of a sound financial strategy.

Setting Financial Goals Before You Invest

Before diving into the best way to invest money, establish clear financial goals. Are you saving for retirement, buying a house, or planning for your child’s education? Goals help you choose suitable investment avenues and assess risks. Without a goal-oriented approach, even the best investment strategies can fall short.

Top Investment Options: Exploring the Best Way to Invest Money

There are countless ways to invest money, but choosing the right one depends on your risk appetite and timeline.

- Stock Market: Ideal for long-term growth.

- Mutual Funds: A diversified and managed approach.

- Real Estate: Great for passive income and asset appreciation.

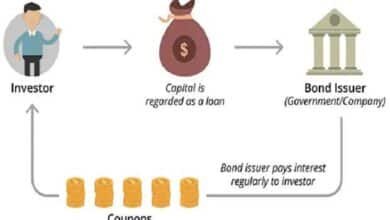

- Bonds: A safe option for consistent returns.

- Cryptocurrency: High-risk, high-reward investments.

Each option has its pros and cons, but diversifying across several is often the best way to invest money wisely.

How to Minimize Risk in Your Investments

Minimizing risk is a critical component of the best way to invest money. Start by understanding your risk tolerance and aligning investments accordingly. Diversify your portfolio to spread potential losses. Regularly review your investments and adapt to market conditions. Risk management ensures your financial safety while maximizing returns.

Investing for Beginners: Steps to Start Investing Money

For beginners, the best way to invest money is to start small and learn along the way. Begin by setting up an emergency fund and understanding basic financial concepts. Open an investment account, consider low-cost index funds, and gradually expand your portfolio. Education and patience are key to long-term success.

The Role of Technology in Modern Investments

Technology has transformed the best way to invest money. Platforms like Robo-advisors, stock trading apps, and cryptocurrency exchanges have simplified the process. With AI tools providing insights, even novice investors can make informed decisions. Leveraging technology ensures convenience and efficiency in managing your investments.

Common Mistakes to Avoid When Investing Money

Even the best way to invest money can fail if common mistakes are overlooked. Avoid emotional decision-making, neglecting diversification, and chasing high-risk returns. Keep a long-term perspective and always research before investing. Learning from mistakes and staying disciplined are hallmarks of successful investors.

Conclusion

Investing is a powerful tool to achieve financial independence. The best way to invest money involves setting clear goals, diversifying your portfolio, and continuously educating yourself. By adopting disciplined strategies and avoiding common pitfalls, you can secure a prosperous future. Begin today, and watch your wealth grow!

FAQs

1. What is the best way to invest money for beginners?

For beginners, the best way to invest money is to start with low-cost index funds, set clear goals, and focus on long-term growth.

2. How much money should I invest initially?

The amount depends on your financial capacity. Start small, even with $100, and gradually increase as you gain confidence and resources.

3. Is real estate the best way to invest money?

Real estate is a great option for generating passive income and building long-term wealth, but it requires significant upfront capital.

4. Can I invest money without taking risks?

All investments carry some risk. However, options like government bonds and high-yield savings accounts are safer alternatives.

5. How do I know which investment option is best for me?

Assess your financial goals, risk tolerance, and timeline. Consulting with a financial advisor can also help identify the best way to invest money for your needs.